It’s time for the 2012 edition of Tax That Married Couple. Let’s jump right in to the numbers. For previous posts on this topic, check out the Taxes tag. Here’s the tax charts for last year and this year:

2011 Taxes

Single Filer 2011

10% on the income between $0 and $8,500

15% on the income between $8,500 and $34,500

25% on the income between $34,500 and $83,600

28% on the income between $83,600 and $174,400

33% on the income between $174,400 and $379,150

35% on the income over $379,150; plus $110,016.50

Married Filer

10% on the income between $0 and $17,000

15% on the income between $17,000 and $69,000

25% on the income between $69,000 and $139,350

28% on the income between $139,350 and $212,300

33% on the income between $212,300 and $379,150

35% on the income over $379,150; plus $102,574

2012 Taxes (from page 105 of the 1040 instructions)

Single Filer 2012

10% on the income between $0 and $8,700

15% on the income between $8,700 and $35,350

25% on the income between $35,350 and $85,650

28% on the income between $85,650 and $178,650

33% on the income between $178,650 and $388,350

35% on the income over $388,350; plus $112,683.50

Married Filer

10% on the income between $0 and $17,400

15% on the income between $17,400 and $70,700

25% on the income between $70,700 and $142,700

28% on the income between $142,700 and $217,450

33% on the income between $217,450 and $388,350

35% on the income over $388,350; plus $105,062

Ok, as in all other years I’ve been doing this, the break happens between the 25% and 28% brackets. When you’re married, you’d think you could stay in the 25% bracket until you collectively make $171,300 (which is double the upper bound of the 25% bracket), but no, you jump to 28% at $142,700. That is $28,600 earlier. Last year, the 28% bracket started $27,850 earlier. It just keeps getting sooner and sooner.

The salary range for couples getting screwed this year is between $71,350 and $85,650, a range of $14,300. That’s about the same as it was last year. So if you and your new spouse are fairly successful and equal earners in that salary range, surprise and congratulations! Why do gay people want this?

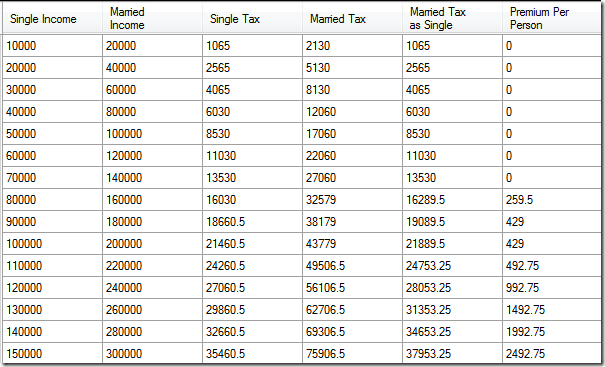

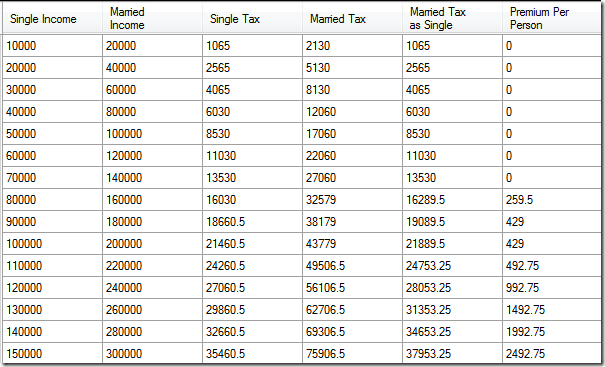

So all these years, I’ve been complaining about this marriage penalty, but there is a common belief that you pay less taxes when you are married. The tax charts in the 1040 instructions stop at $100,000, so there is no easy way to visually compare a single person earning $50k or more against a married couple who each earn $50k or more. So I wrote a quick program to calculate taxes using the single and married tax charts and ran a bunch of numbers through it. Here’s the results:

Single Income is just what it sounds like. Married Income is double that value, assuming both people making the same amount. Single tax calculates the Single income against the single tax chart. Married tax calculates the Married income against the married tax chart. Married Tax as Single simply divides the total married tax in half, showing each person’s share of the married tax burden. Premium per Person shows how much more each person is paying for being married.

My plan was to find out at what point your taxes become lower when being married. I wanted to make the point that it happens at an unreasonably high income level. It turns out that the savings never happen. After the tax rate split at about $71k, you pay more being married. It’s not as much as I originally calculated, but still more.

In all my previous posts on taxes, I definitely exaggerated the impact of this marriage penalty, and because of the graduated tax chart, I was miscalculating its financial effect. I regret that a little. But with more in-depth research, I found that the actual situation isn’t all that much better. The more income you make when married, the better off you are being single, starting at $71k.

I think I’ve now beaten this topic into the ground and I won’t bother doing these in future years unless something interesting happens with the tax code.