For a few years, I used to do a post on taxes, specifically regarding the “marriage penalty”. It was a rant post because I was married at the time and we were getting dicked over by this penalty. Things have gotten a lot better in that regard lately (as in me getting divorced), so I stopped making those posts back in 2013.

I saw a post by someone who was complaining that the new tax laws were changing his taxes for the worse. By using an estimating calculator, he had to increase his withholding rate, but was getting more back per paycheck. It sounds like a strange con game, give me more and I’ll give you more. And simply because of that weirdness, I got wondering how the marriage penalty shakes out under the new tax law. So I went looking.

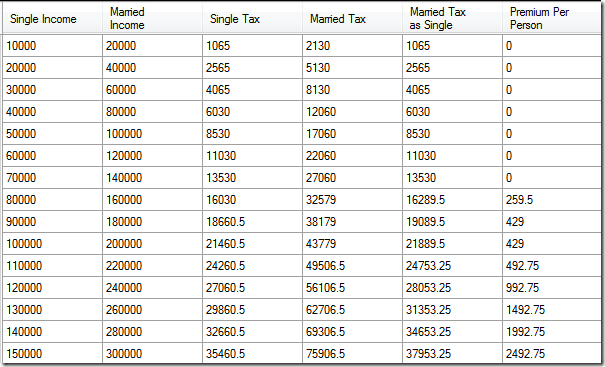

Here’s the surprise, there is no marriage penalty anymore (for the common person). If you are a married filer, your tax table breaks at 2X the single income – at every bracket. Except… if you make over $300,000 each. Like I commented, not the common couple.

It would make sense that any tax “improvement” would offer a gain for normal income people and a proportionally higher gain for extraordinary income people. That’s a gripe for another post. The point of this post is that the marriage penalty is gone.

Just for retrospective kicks, let’s look at what could have been if we did not have the tax “reform”. Looking at the 2017 tax brackets, as in all other years, the disconnect happens in the upper tier of the 25% bracket. If you are single, you would be bumped to the 28% bracket at $91,900. If you have two married people making $76,550 each, that couple will be taxed at 28%. That is the marriage penalty – you are bumped to a higher tax rate sooner from your combined wages. Said another way for clarity, if you and your partner made $77k each and were not married, you each got taxed at 25%. Then you get married and with no change to your salaries, now you’re paying 28% in taxes. And that sucks even harder if you get married later in the year, because your employer has been withholding taxes expecting you to be in a 25% bracket. You will have less withheld when you do your taxes and learn you’re now at 28%.

You might think this new tax table is awesome, especially if you were previously hit with the marriage penalty, but it’s not better or worse, just different. The marriage penalty primarily affects DINKs (dual-income, no kids), especially young professionals, and in these modern times, married gay people. The tax system up to now has favored and encouraged one married member being a breadwinner and the other being a homemaker. This high income of the breadwinner has no extra income from the homemaker and is able to utilize the full deduction of both people against one income.

So, now that the incentive is gone to have two people living under one income, all the people who structured their marriage in this way, on purpose, or by accident, or by default, they are going to pay more in taxes. That could be the case for this post I read.